Bitcoin’s Institutional Surge: Market Dynamics and Future Prospects

Bitcoin, the flagship cryptocurrency, remains a focal point in the evolving landscape of digital assets. As of late, institutional interest in Bitcoin has been surging, driven by various factors that are reshaping the market dynamics. Recent data and expert analyses suggest a strong correlation between Bitcoin’s price movements and institutional activities, which have had significant implications for both the asset’s valuation and its adoption trajectory.

The Rise of Institutional Interest

Notable among recent developments is Anthony Scaramucci’s SkyBridge Capital making strategic Bitcoin purchases. As reported, the firm has been acquiring Bitcoin at different price points, including the current lower range, reflecting a belief in the asset’s long-term value. This move underscores a broader trend where institutions are increasingly viewing Bitcoin as a hedge against inflation and a viable store of value.

Scaramucci’s actions align with a growing institutional appetite for digital assets, as highlighted by the boom in tokenized real-world assets (RWAs). Institutions are not only investing in Bitcoin but are also exploring other avenues such as tokenized treasuries and funds, indicating a diversification strategy within the crypto space.

Market Analysis and Implications

The institutional influx into Bitcoin has significant market implications. According to recent analyses, the presence of institutional investors typically brings increased liquidity and stability to the market. However, it also raises questions about potential market manipulation and the future regulatory landscape.

On the regulatory front, regions like Hong Kong are making strides, with the Securities and Futures Commission working on frameworks to accommodate perpetual contracts. This regulatory clarity is crucial as it provides a safer environment for institutional investors, further legitimizing Bitcoin as an asset class.

Technological and Regulatory Context

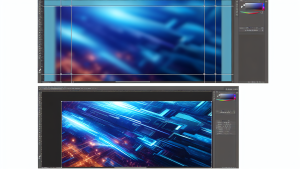

Technological advancements are also playing a pivotal role in Bitcoin’s evolving narrative. Robinhood’s testing of its own blockchain, built on Ethereum’s Arbitrum, aims to integrate tokenized stocks into decentralized finance (DeFi). This development could potentially streamline trading processes and enhance Bitcoin’s utility in financial markets.

Meanwhile, the regulatory landscape continues to evolve. The White House’s recent meeting with crypto executives and bankers reflects ongoing tensions, particularly regarding stablecoin yields. While bankers have been resistant, advocating for a ban, such discussions highlight the need for a balanced regulatory approach that fosters innovation while ensuring market stability.

Future Prospects

Looking ahead, Bitcoin’s future seems promising but not without challenges. The ongoing efforts to bridge traditional finance with decentralized systems, as seen with Spark’s initiative, could unlock new avenues for Bitcoin’s use. By opening access to its stablecoin liquidity pool, Spark aims to connect on-chain capital with off-chain credit markets, potentially increasing Bitcoin’s appeal to institutional investors.

However, Bitcoin’s path forward will depend significantly on how well it navigates regulatory hurdles and technological challenges. The need for robust infrastructure and clear regulations cannot be overstated, as these elements are critical to sustaining institutional interest and driving broader adoption.

- Institutional Adoption: Key driver of Bitcoin’s growth.

- Regulatory Developments: Critical for market stability.

- Technological Integration: Enhances utility and efficiency.

Conclusion

In conclusion, Bitcoin’s journey is marked by a dynamic interplay of institutional interest, technological innovation, and regulatory evolution. As institutions continue to invest and regulatory frameworks become clearer, Bitcoin is poised to solidify its position in the global financial ecosystem. The coming years will likely see Bitcoin not just as a speculative asset, but as a cornerstone of the digital economy.