Bitcoin’s Resilience Amidst Market Fluctuations and Regulatory Challenges

Bitcoin has always been at the forefront of the cryptocurrency revolution, standing as a beacon of financial innovation and digital asset resilience. Despite its volatile nature, Bitcoin continues to capture the attention of investors, regulators, and enthusiasts alike. In recent months, Bitcoin has had to navigate through a landscape marked by regulatory pressures, market fluctuations, and evolving investor sentiments.

Current Market Dynamics

Bitcoin’s price movement has been a rollercoaster, showcasing its inherent volatility. As of early 2023, Bitcoin prices have experienced a significant drop, reflecting the broader crypto market downturn. According to data, Bitcoin’s price has plummeted by nearly 15% since the start of the year, impacting the portfolios of both retail and institutional investors. This downturn is largely attributed to a combination of macroeconomic factors, including inflationary pressures and geopolitical tensions.

Moreover, market participants have been cautious due to the looming regulatory frameworks being discussed globally. The recent White House meeting highlighted the growing tension between crypto advocates and traditional financial institutions. Bankers, for instance, have been persistent in their call for a ban on stablecoin yields, which could have a ripple effect on Bitcoin and the broader crypto ecosystem.

Regulatory Environment and Its Impact

The regulatory environment for Bitcoin and cryptocurrencies continues to evolve rapidly. Policymakers worldwide are grappling with the challenge of integrating cryptocurrencies into existing financial systems while ensuring consumer protection and financial stability. In the United States, the Securities and Exchange Commission (SEC) has been actively pursuing cases against fraudulent crypto schemes, reflecting a stringent regulatory stance.

One notable case involves Braden John Karony, the former CEO of SafeMoon, who received an eight-year prison sentence for defrauding investors. Such high-profile cases underscore the importance of regulatory oversight in the crypto space. However, these regulatory actions have also instilled a sense of caution among crypto investors, impacting market liquidity and price stability.

Strategic Investments and Technological Innovations

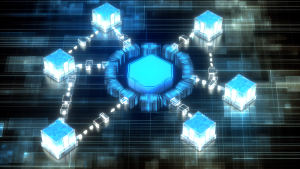

Despite these challenges, strategic investments and technological innovations continue to drive the crypto space forward. Companies like Citadel Securities and Tether are making significant inroads by investing in cross-chain technologies such as LayerZero Labs. This move towards interoperability is crucial for Bitcoin’s integration into global markets and its adoption across various financial systems.

LayerZero’s focus on Omnichain infrastructure (OFT) is particularly noteworthy. It allows for seamless stablecoin transactions across different blockchain networks, thereby enhancing liquidity and promoting agentic finance use cases. Such innovations are pivotal for the next phase of Bitcoin’s growth, offering solutions to scalability and transaction speed issues that have long plagued the network.

Bitcoin’s Long-Term Outlook

Despite short-term volatility, the long-term outlook for Bitcoin remains promising. Institutional interest in Bitcoin is on the rise, with firms like Strategy reaffirming their commitment to a long-term Bitcoin strategy. Michael Saylor, Strategy’s Executive Chairman, has emphasized the firm’s dedication to holding Bitcoin as a strategic asset, even amidst significant market losses. His comments underscore the belief that Bitcoin will continue to serve as a hedge against inflation and currency devaluation.

Furthermore, the increasing involvement of political entities in crypto debates, as seen with the Crypto PAC Fairshake’s investment in pro-crypto candidates, suggests that Bitcoin and cryptocurrencies are becoming integral to political and economic discourse.

Conclusion

Bitcoin’s journey is emblematic of the broader cryptocurrency market’s evolution. While challenges persist, from regulatory scrutiny to market volatility, Bitcoin’s foundational technology and strategic investments signal a resilient future. As investors, regulators, and innovators continue to navigate this complex landscape, Bitcoin remains a central figure in discussions about the future of finance.