Solana’s Volatility and Growth: What Lies Ahead for This Promising Blockchain?

Solana, one of the leading blockchain platforms known for its high-speed transactions and low fees, continues to capture the interest of investors and developers worldwide. Despite facing significant market fluctuations, Solana’s innovative technology positions it as a formidable contender in the cryptocurrency space.

Solana’s Market Volatility

The cryptocurrency landscape is notoriously volatile, and Solana is no exception. Recent reports suggest that in 2025, Solana’s volatility was twice that of Bitcoin, highlighting the unpredictable nature of altcoin investments. This volatility underscores the need for deeper liquidity in exchange-traded funds (ETFs) tied to altcoins, which are essential to provide stability akin to Bitcoin’s.

Technological Advantages

Solana distinguishes itself through its unique proof-of-history (PoH) consensus mechanism, which significantly enhances transaction throughput. This innovation allows Solana to process over 50,000 transactions per second, making it an attractive option for decentralized applications (DApps) and enterprises seeking scalable solutions.

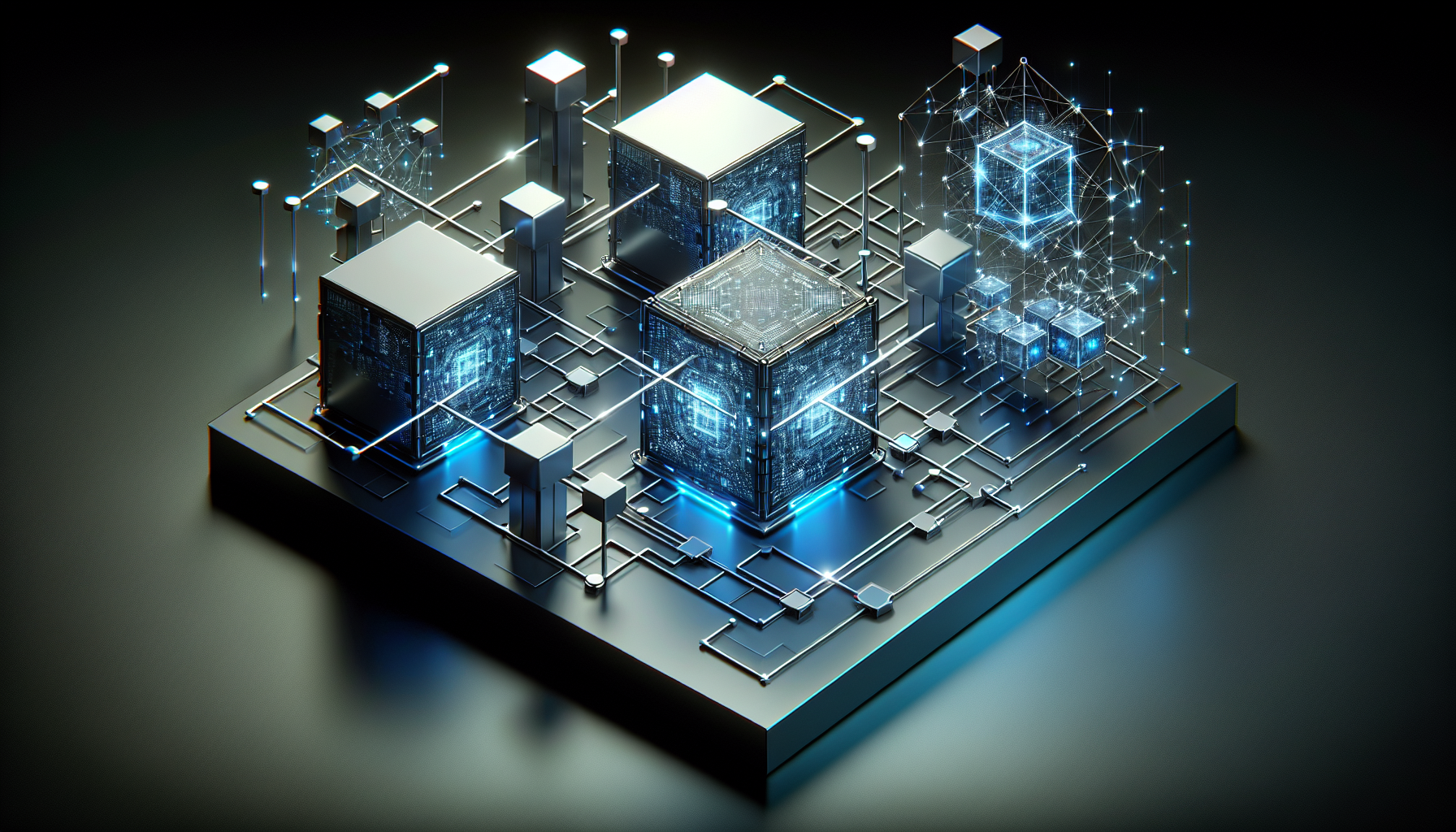

Growing Ecosystem

The Solana ecosystem continues to expand with a surge in developers building on the platform. Its robust architecture supports a wide array of projects, from decentralized finance (DeFi) applications to non-fungible tokens (NFTs), contributing to its growing total value locked (TVL) and ecosystem diversity.

Challenges and Prospects

Despite its advantages, Solana faces challenges, including network outages and security vulnerabilities. However, continuous upgrades and an active developer community are working tirelessly to address these issues, ensuring long-term sustainability and growth. As the blockchain industry evolves, Solana’s potential for innovation and scalability positions it as a key player in shaping the future of decentralized technologies.

Market Analysis

Korbit fined $1.9 million for anti money-laundering, customer verification breaches

The South Korean regulator slapped Korbit with a compliance penalty as the crypto exchange conducts talks to be bought by Mirae Asset.

Bitcoin got stuck after slumping 30% from its peak. Here's why.

The October flash crash exposed how fragile bitcoin’s rally had become. It also illustrated a fundamental change in how BTC is perceived.

Bitwise files for 11 'strategy' ETFs, tracking tokens including AAVE, ZEC, TAO

The exchange-traded funds will invest both directly and indirectly in the tokens.