DEX Wars: Uniswap vs. SushiSwap vs. PancakeSwap

The rise of decentralized finance (DeFi) has brought decentralized exchanges (DEXs) to the forefront of crypto trading. Among the top contenders, Uniswap, SushiSwap, and PancakeSwap have established themselves as major players. But which DEX stands out in terms of liquidity, user experience, and innovation? Let’s dive into the features, recent developments, and community sentiment surrounding these platforms to see how they stack up against each other.

Uniswap: The Pioneer of Decentralized Exchanges

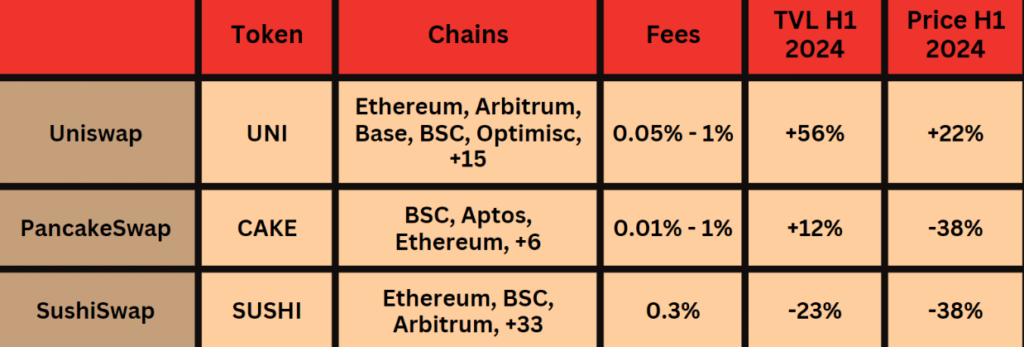

Uniswap is often credited with popularizing the automated market maker (AMM) model, which revolutionized how users trade tokens directly from their wallets. With its simple interface and vast pool of liquidity, Uniswap remains the go-to DEX for many.

Key Features:

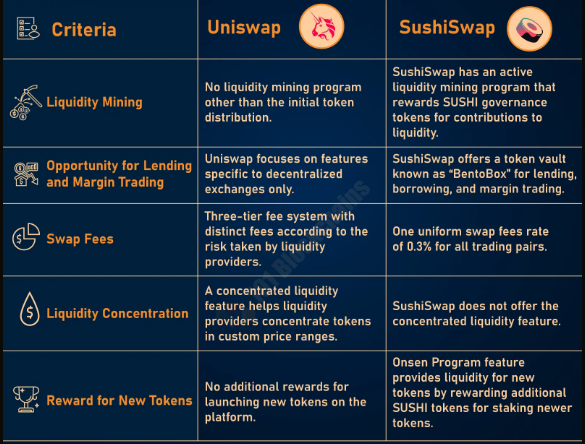

- Liquidity: Uniswap boasts deep liquidity across thousands of trading pairs, making it a top choice for traders seeking minimal slippage.

- User Experience: Known for its user-friendly interface, Uniswap makes it easy for both beginners and experienced traders to swap tokens effortlessly.

- Innovation: Uniswap V3 introduced concentrated liquidity, allowing liquidity providers to earn higher fees by focusing on specific price ranges.

Recent Developments:

Uniswap’s transition to Layer 2 solutions like Optimism and Arbitrum has significantly reduced gas fees and transaction times, making it more accessible to users with smaller portfolios. Moreover, the introduction of Uniswap’s Universal Router in late 2023 has enhanced trade efficiency by routing orders through the most profitable paths.

SushiSwap: The Community-Driven Contender

SushiSwap emerged as a community-driven fork of Uniswap, with additional features designed to benefit token holders and liquidity providers. Despite its controversial beginnings, SushiSwap has grown into a robust DEX with a loyal following.

Key Features:

- Liquidity Mining: SushiSwap offers lucrative liquidity mining programs, incentivizing users to provide liquidity in exchange for SUSHI tokens.

- Governance: SUSHI token holders have a say in the platform’s governance, allowing the community to vote on proposals and future developments.

- Additional Services: Beyond token swapping, SushiSwap offers a suite of DeFi services, including staking, lending, and yield farming.

Recent Developments:

SushiSwap recently launched Trident, a next-gen AMM framework that promises more flexibility and efficiency in liquidity provision. Additionally, the platform’s MISO (Minimal Initial Sushi Offering) launchpad has gained popularity as a decentralized platform for new token launches.

PancakeSwap: The Binance Smart Chain Favorite

Built on Binance Smart Chain (BSC), PancakeSwap has quickly become the leading DEX on this fast-growing network. With its lower fees and fun, gamified features, PancakeSwap appeals to a broad audience.

Key Features:

- Low Fees: Operating on BSC, PancakeSwap offers significantly lower transaction fees compared to Ethereum-based DEXs.

- Yield Farming: PancakeSwap provides a wide range of yield farming opportunities, where users can earn CAKE tokens by staking LP tokens.

- Lottery & NFTs: The platform also features lotteries, prediction markets, and NFT trading, making it more engaging for users.

Recent Developments:

PancakeSwap has expanded its offerings with the launch of IFO (Initial Farm Offering), allowing projects to raise funds by selling tokens directly to PancakeSwap users. Additionally, its recent cross-chain integrations with Ethereum and Aptos open up new opportunities for users to trade assets across different networks seamlessly.

Community Sentiment and Engagement

Social media engagement is a strong indicator of a platform’s success and community support. Let’s take a look at how these DEXs fare on platforms like Twitter and Reddit:

- Uniswap: With a large and active community, Uniswap often trends during major upgrades or announcements. The platform enjoys strong support, especially from Ethereum enthusiasts.

- SushiSwap: SushiSwap’s community is highly engaged, often participating in governance votes and discussions. The platform’s focus on community-driven development keeps its user base loyal.

- PancakeSwap: PancakeSwap’s community is vibrant, particularly on Binance-centric platforms. Its fun and interactive features, like the PancakeSwap lottery, drive high levels of user engagement and social media buzz.

Final Thoughts: Which DEX Reigns Supreme?

The battle between Uniswap vs. SushiSwap vs. PancakeSwap is far from over. Each DEX brings something unique to the table, from Uniswap’s pioneering innovations to SushiSwap’s community-driven governance, and PancakeSwap’s low fees and gamified experience.

If you’re looking for deep liquidity and a seamless trading experience on Ethereum, Uniswap remains a top choice. SushiSwap offers a more community-centric approach, with added DeFi services and governance perks. Meanwhile, PancakeSwap is the go-to for those seeking low fees and a more engaging user experience on Binance Smart Chain.

Ultimately, the best DEX for you depends on your specific needs and preferences. As these platforms continue to innovate and grow, staying informed on their latest developments will help you make the most of your DeFi journey.