Tokenomics Deep Dive: Understanding Supply and Demand Dynamics

In the ever-evolving world of cryptocurrencies, tokenomics plays a crucial role in determining the value and long-term viability of different tokens. The interplay of supply and demand dynamics directly impacts price stability and growth potential. Let’s explore how these factors influence the market, focusing on popular cryptocurrencies like Bitcoin, Ethereum, and emerging altcoins.

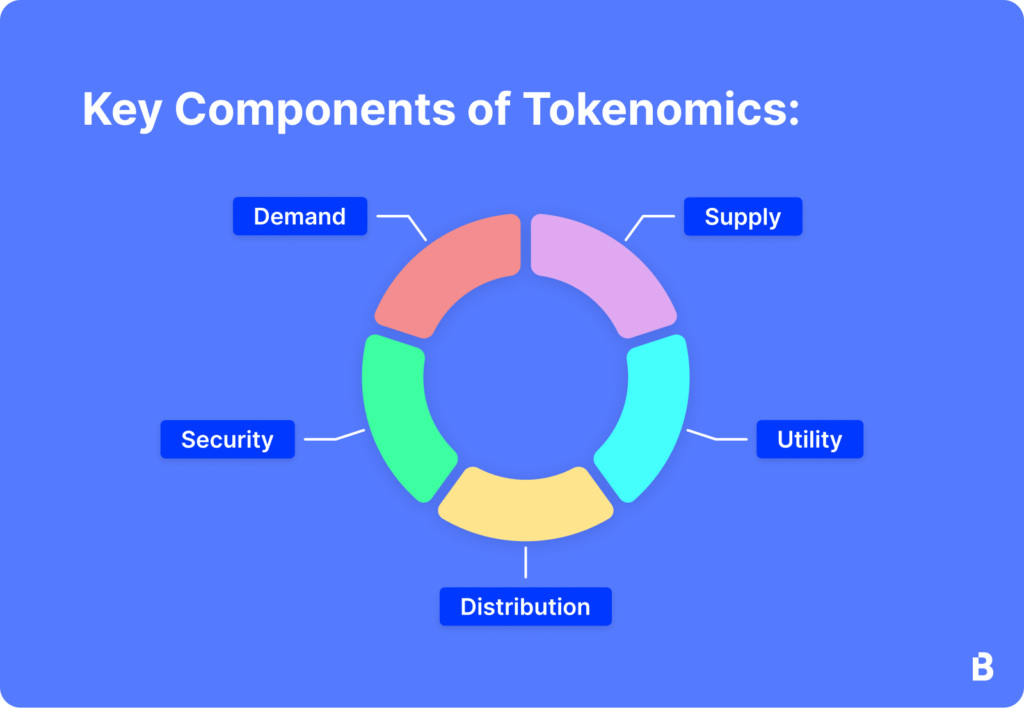

What is Tokenomics?

Tokenomics is the economic framework governing a cryptocurrency’s creation, distribution, and destruction. In other words, it’s how a token’s economy functions. This framework heavily influences the token’s value by regulating its supply and demand.

Supply Dynamics: Fixed vs. Inflationary

The supply side of tokenomics is pivotal in shaping a cryptocurrency’s value. Different projects adopt either a fixed or inflationary supply model.

- Fixed Supply: Bitcoin is the most prominent example, with its total supply capped at 21 million coins. As more people buy Bitcoin and its supply remains constant, its scarcity drives up the price. This phenomenon is a classic example of deflationary economics.

- Inflationary Supply: Ethereum, in contrast, started with an inflationary supply model, where new ETH tokens are created regularly. However, the shift toward Ethereum 2.0 is gradually making it more deflationary. The introduction of EIP-1559, which burns a portion of transaction fees, has played a significant role in this transition.

Demand Dynamics: Utility and Adoption

A token’s utility within its ecosystem primarily drives demand. The broader the application of a token, the greater its demand.

- Bitcoin’s Utility: Bitcoin is primarily viewed as “digital gold,” a store of value. Although its use as a medium of exchange is growing, its demand spikes mainly during economic uncertainty, driving prices higher.

- Ethereum’s Utility: Ethereum has a broader application, especially in decentralized finance (DeFi) and smart contracts. Its utility in powering various decentralized applications makes it highly sought after. Additionally, the introduction of staking in Ethereum 2.0 has further increased demand, as users lock up their ETH to earn rewards.

The Role of Inflation and Burn Rates

Inflation in cryptocurrency can be both beneficial and detrimental, depending on how it’s managed.

- Bitcoin’s Controlled Inflation: Bitcoin manages inflation through a process called “halving,” where the rewards for mining new blocks are cut in half approximately every four years. This reduction in new supply often leads to price increases.

- Ethereum’s Burn Mechanism: Ethereum’s EIP-1559 update introduced a mechanism that burns a portion of transaction fees, effectively reducing the overall supply. This burn rate helps counterbalance inflation by applying deflationary pressure, which can increase the token’s value over time.

Visualizing Tokenomics: Supply Curves and Staking Incentives

Visual aids like supply curves and staking incentives make these concepts easier to understand.

- Supply Curves: For Bitcoin, a downward-sloping supply curve flattens as it approaches the 21 million cap, indicating limited new supply. For Ethereum, the curve shows gradual increases with occasional dips, thanks to burn rates.

- Staking Incentives: Staking creates a “lock-up curve,” showing how much of a token’s supply is held in staking contracts. This reduction in liquid supply can lead to higher demand, potentially driving up prices.

Comparing Tokenomics Models: Bitcoin vs. Ethereum vs. Emerging Altcoins

Different tokenomics models offer varying impacts on price stability and growth potential.

- Bitcoin: Bitcoin’s fixed supply makes it an attractive asset for long-term holders, contributing to its deflationary nature and price appreciation.

- Ethereum: Ethereum’s evolving tokenomics model, with its combination of inflationary issuance and deflationary burns, makes it a versatile and valuable asset.

- Emerging Altcoins: Projects like Solana and Cardano offer unique tokenomics. Solana employs an inflationary model, while Cardano uses a mix of staking incentives and burns. The success of these altcoins will depend on how well they manage their supply and demand dynamics.

Recent Developments and Their Implications

Ethereum’s EIP-1559 and ETH 2.0 Transition: The move towards Ethereum 2.0 has started to impact its supply dynamics, reducing circulating supply due to staking and burning mechanisms. This shift could make ETH more valuable over time.

Bitcoin Halving Cycles: Bitcoin’s next halving, expected in 2024, is already generating excitement. Historically, halving events have significantly impacted prices due to reduced new supply.

Regulatory News: Recent regulatory scrutiny of altcoins could also influence tokenomics by introducing new constraints that affect supply and demand.

Wrapping Up

Understanding tokenomics is essential for evaluating a cryptocurrency’s investment potential. The balance between supply, demand, inflation, and utility shapes the token’s future. Whether you’re looking at Bitcoin’s fixed supply, Ethereum’s evolving model, or the experimental approaches of emerging altcoins, tokenomics will play a critical role in the success of these digital assets.