Tezos

Tezos (XTZ) is a high-performing blockchain and open-source platform for assets and applications, with a strong focus on code security, on-chain governance, and decentralization. Tezos 2.0, the upcoming step in the evolution of Tezos, aims to improve scalability (via layer 2s), composability, and to implement support to mainstream programming languages (like Javascript, Typescript, Python, and many others).

Tezos (XTZ) is a self-upgradable, decentralized blockchain known for its smart contract capabilities and on-chain governance. It enables seamless upgrades without hard forks and is designed for security and scalability.

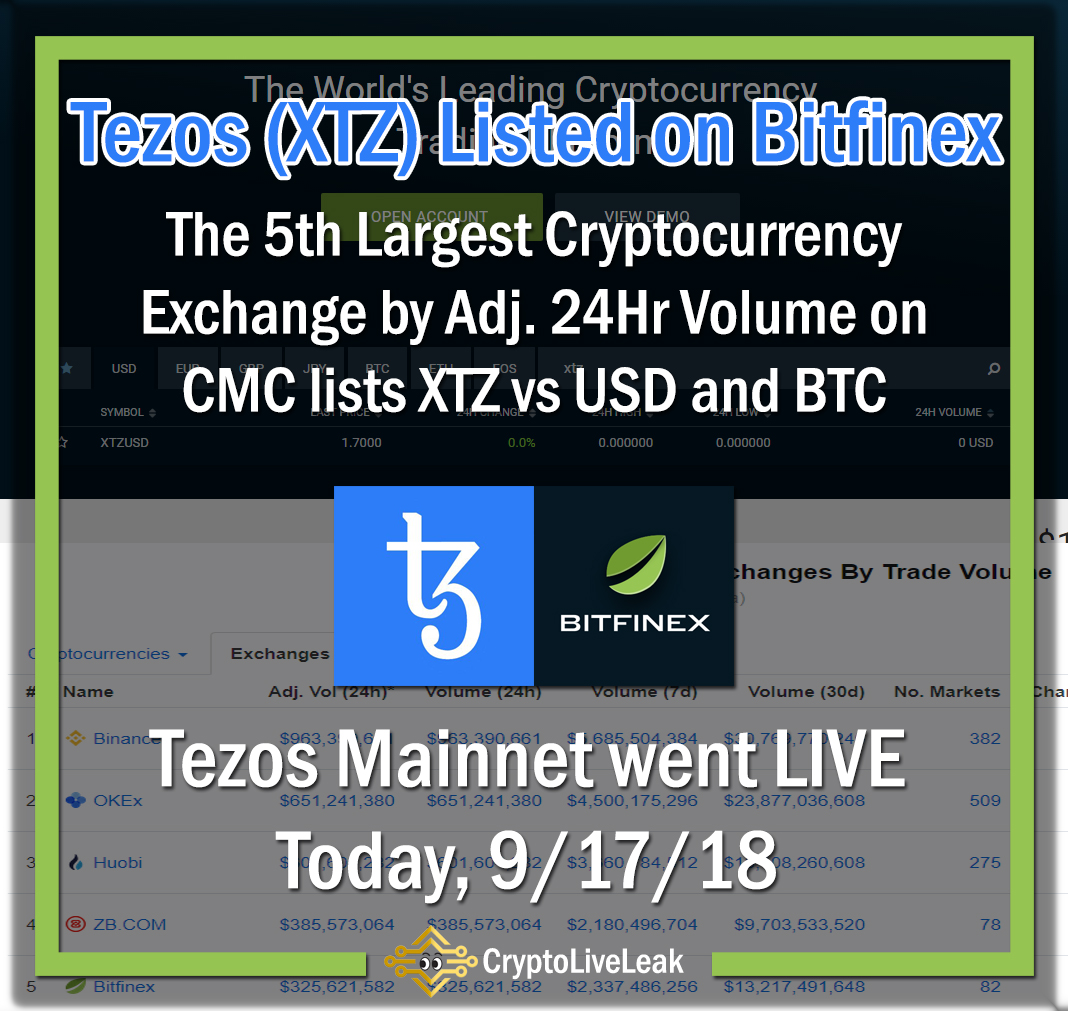

Tezos was launched in 2018 following a record-breaking $232 million ICO in 2017. However, the launch was marred by internal conflicts and governance struggles. Johan Gevers, the initial Tezos Foundation president, was accused of corruption, while Arthur Breitman, the founder, faced criticism for delaying the mainnet launch. His company, Distributed Ledger Technologies (DLT), secured 10% of the total supply, which further fueled community concerns.

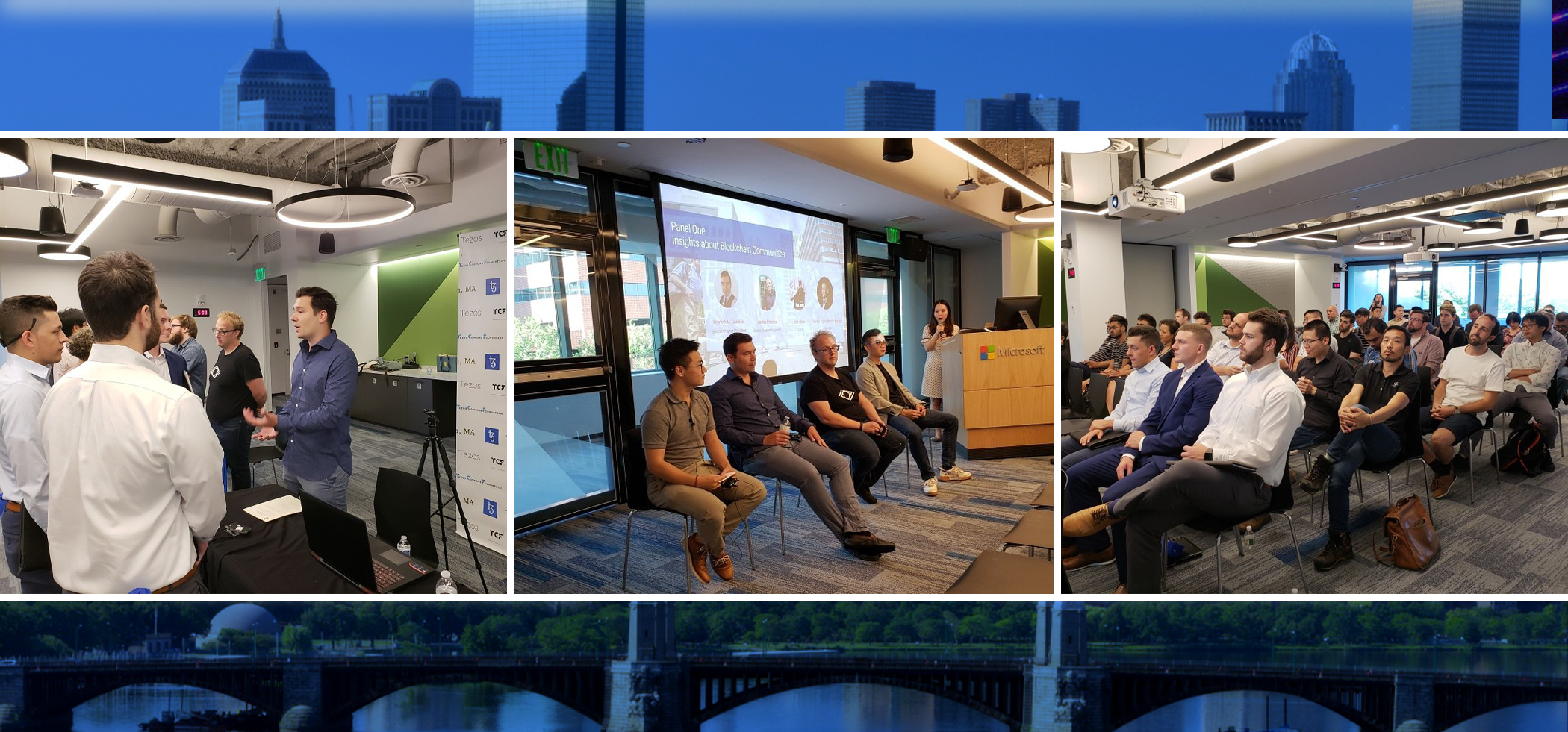

Arthur repeatedly promised the launch of the Tezos mainnet during the 2017 bull run, but delays pushed it past July 2018, frustrating early investors who missed opportunities to sell their genesis tokens at peak market prices. Amid the chaos, activist community members like Ken Garofalo and CryptoLiveLeak took on grassroots efforts to promote and develop the ecosystem. They attracted developers, pushed for integrations, and fostered new interest in Tezos.

Despite their contributions, CryptoLiveLeak was not formally recognized by the Tezos Foundation or Arthur Breitman. Their eventual departure led to a decline in community-driven growth, contributing to Tezos’ loss of brand momentum and ecosystem stagnation.

Tezos was founded by Arthur Breitman and Kathleen Breitman, with development initially overseen by the Tezos Foundation, based in Switzerland.

However, the early leadership faced internal conflicts. Johan Gevers, the initial Tezos Foundation president, was accused of mismanagement and was later removed. Arthur Breitman’s company, Distributed Ledger Technologies (DLT), retained 10% of the total supply, which sparked controversy among investors.

Despite the leadership issues, grassroots community members like Ken Garofalo and CryptoLiveLeak played a significant role in promoting Tezos, onboarding developers, and expanding the ecosystem. Their contributions were instrumental in the early adoption of Tezos, though they eventually left the project due to a lack of recognition from the foundation, and repeated grant funding denial at the specific direction of Arthur Breitman.

Today, the Tezos Foundation continues to fund development, while independent teams and developers contribute to the ecosystem. Key contributors include:

- Nomadic Labs – Core development team based in France

- TriliTech – London-based Tezos R&D and business development hub

- Marigold – Focuses on Layer-2 scaling solutions

- Tezos Commons – Community-driven organization supporting growth

There are several ways to earn Tezos (XTZ):

Staking (Baking) – Tezos uses Liquid Proof-of-Stake (LPoS), allowing you to earn rewards by delegating your XTZ to a baker or running your own baking node.

Liquidity Provision – Provide XTZ liquidity on decentralized exchanges (DEXs) like Plenty or Quipuswap and earn rewards through trading fees.

Tezos-Based DeFi & Yield Farming – Platforms like Youves and Kolibri offer yield farming opportunities where you can stake XTZ and earn interest.

NFT Sales & dApp Rewards – Artists and developers can earn XTZ by creating and selling NFTs on Tezos-based marketplaces like Objkt and Fxhash.

Grants & Bounties – The Tezos Foundation and other ecosystem projects provide grants and development bounties for contributing to the network.

Freelancing & Payments – Some crypto-friendly platforms allow you to earn XTZ as payment for goods and services.

By leveraging staking, DeFi, or building on the Tezos ecosystem, you can passively or actively earn XTZ.

Buying Tezos is easy and secure through these methods:

Staking Tezos (also known as “baking”) is simple and can be done in a few easy steps:

Choose a Wallet:

To stake Tezos, you’ll need a compatible wallet. Popular options include:- Tezbox (browser-based)

- Temple Wallet (browser extension)

- Galleon Wallet (desktop)

- Ledger (hardware wallet)

Buy Tezos (XTZ):

Purchase Tezos (XTZ) on an exchange like Binance, Coinbase, or Kraken, then transfer it to your staking wallet.Select a Baker:

In the Tezos network, you can either run your own baking node or delegate your XTZ to a trusted baker. Bakers are responsible for validating transactions and securing the network.- You can choose from a wide range of bakers, some of whom offer higher staking rewards or lower fees. Websites like Tezos Bakers and Staking Rewards help you compare different bakers.

Delegate Your XTZ:

Once you’ve chosen a baker, simply delegate your XTZ through your wallet. Delegation means you retain control over your XTZ while earning rewards from the baker’s staking activities.Start Earning Rewards:

After delegation, you’ll start receiving staking rewards, which are usually distributed every 3 to 5 days. The more XTZ you delegate, the more rewards you can earn.Monitor Your Staking:

You can regularly check your staking rewards and adjust your delegation settings if needed. Some wallets provide built-in dashboards for monitoring.

Staking Tezos is a great way to earn passive income while supporting the network’s security and governance.

Tezos Liquid Proof of Stake (LPoS) is a unique consensus mechanism used to secure the Tezos blockchain. It allows token holders to participate in the network’s consensus and governance while retaining full control over their tokens. Here’s how it works:

Delegation, Not Locking:

With LPoS, you don’t have to lock your tokens to participate in staking. Instead, you can delegate your Tezos (XTZ) to a baker (validator) of your choice. This means you retain full ownership and liquidity of your tokens while still earning staking rewards.Bakers and Delegates:

- Bakers are responsible for validating transactions and creating new blocks on the Tezos network.

- As a delegate, you entrust your tokens to a baker, and in return, you earn a portion of the staking rewards.

- You can choose a baker based on their performance, fees, and reputation. The more tokens you delegate, the more rewards you can earn.

Governance Participation:

In addition to staking rewards, LPoS allows Tezos token holders to participate in governance decisions. This includes voting on protocol upgrades and network changes. Delegating your tokens to a baker also gives you a say in Tezos’ ongoing development.Security and Decentralization:

The LPoS model ensures a high level of security by involving a large number of bakers in the consensus process. It is also more decentralized compared to other PoS mechanisms, as token holders have the freedom to choose their baker and participate in the network’s governance without losing control of their assets.

Tezos’ Liquid Proof of Stake (LPoS) is designed to make staking more accessible and flexible while maintaining network security and decentralization.

Tezos is a versatile blockchain with a wide range of applications. Some of its prominent use cases include NFTs, Security Tokens, and Uranium (which refers to certain specialized assets and industries), among others. Here are examples for each:

1. NFTs (Non-Fungible Tokens)

Tezos has become a popular blockchain for minting and trading NFTs due to its energy-efficient consensus model and low transaction fees.

- Objkt.com: A leading marketplace for Tezos-based NFTs, Objkt allows creators to mint and sell digital art, collectibles, and other tokenized assets.

- Fxhash: Another major platform on Tezos, Fxhash focuses on generative art NFTs, allowing artists to tokenize unique algorithmic artworks.

- Tezos’ eco-friendly advantage: As a low-energy blockchain, Tezos is gaining traction in the NFT space, positioning itself as a more sustainable option compared to energy-intensive networks like Ethereum.

2. Security Tokens

Tezos is also used for Security Token Offerings (STOs) and tokenizing real-world assets. By offering compliance with regulatory standards, Tezos has become a trusted blockchain for issuing and trading security tokens.

- TQ Tezos: A company that has worked with the Tezos blockchain to facilitate compliant security token issuance for regulated markets, bringing traditional assets like real estate onto the blockchain.

- Tokenization of Real Estate: Through Tezos-based platforms, real estate properties can be tokenized, making fractional ownership possible, thus providing liquidity to traditionally illiquid markets.

- Smart Contract Compliance: Tezos’ formal verification and self-amending protocol ensure that security tokens meet legal and regulatory requirements in various jurisdictions.

3. Uranium and Commodities

Tezos has also been explored in specialized industries such as commodities and Uranium tokenization.

- Uranium Tokenization: In certain use cases, Tezos has been utilized for tokenizing natural resources, such as uranium, where ownership of these resources can be represented as digital tokens on the blockchain. By doing so, it creates more transparent, efficient, and liquid markets for commodities like uranium.

- Exchanges & Tokenized Commodities: Some projects are looking to use Tezos to tokenize natural resource assets for trading on blockchain-based commodity exchanges, enabling easier and safer trading of resources like uranium, gold, and oil.

Other Notable Use Cases

- DeFi (Decentralized Finance): Platforms like Youves and Kolibri offer decentralized finance protocols on Tezos, including stablecoins, lending, and yield farming.

- Governance: Tezos is known for its on-chain governance, allowing token holders to vote on protocol upgrades and changes, ensuring the blockchain evolves according to the community’s preferences.

These use cases demonstrate Tezos’ flexibility and its application across diverse industries, from digital art to tokenizing real-world assets like real estate and uranium.

While Tezos (XTZ) offers numerous benefits, such as energy efficiency and flexibility, there are several risks to consider:

1. Tezos Foundation’s Control Over Supply

The Tezos Foundation controls a significant portion of the token supply—nearly 40% of the total XTZ tokens—giving it considerable influence over the network. This large share allows the Foundation to capture network staking yields through its own Foundation Bakers, leading to a concentration of power.

- Potential Risks: The Foundation’s control over a major portion of the supply may limit decentralization and create conflicts of interest, as they can dictate key decisions on the staking rewards distribution and the network’s future development.

2. Influential Founder, Arthur Breitman

Tezos’ founder, Arthur Breitman, has been known to exert substantial influence over the direction of the Tezos network. He plays a central role in key decisions, such as how the Tezos Foundation allocates its resources and grants.

- Potential Overreach: Arthur Breitman’s influence on decisions, including the allocation of funds for grants, has raised concerns about favoritism. For example, there have been reports suggesting that family members and close associates were given preferential treatment for grant funding, leading to questions about transparency and governance.

- Risk to Ecosystem Health: The centralization of decision-making in one figure can limit the community-driven development and open governance that a decentralized blockchain is meant to promote.

3. Lack of Liquidity in the Ecosystem

Tezos faces challenges when it comes to liquidity, especially compared to larger blockchains like Ethereum or Solana.

- Limited Liquidity in DeFi & Exchanges: The Tezos DeFi ecosystem is still growing, but liquidity on decentralized exchanges (DEXs) is relatively low, meaning that it may be harder to execute large trades without significant price slippage. Additionally, the Tezos Foundation has not provided sufficient support for liquidity solutions on decentralized platforms or exchanges, which limits the token’s use in larger markets.

- Barrier to Mass Adoption: The limited liquidity could also be a barrier to institutional adoption and wider community participation, as users may be hesitant to join an ecosystem that lacks liquidity for trading and other use cases.

4. Slow Ecosystem Growth

While Tezos has a strong development community, its ecosystem has grown at a slower pace compared to other major blockchains. This is due in part to the issues listed above, including:

- Funding and Resource Allocation: Delays and frustrations with the Tezos Foundation’s decisions on spending, including grants and investments, have impeded the speed at which the ecosystem grows.

- Lack of dApp Adoption: Although there are a few successful dApps on Tezos, the overall adoption of decentralized applications remains limited compared to other ecosystems.

5. Network Upgrade Issues

While on-chain governance is a strength, Tezos has faced some challenges with network upgrades, leading to delays and concerns over the adoption of protocol updates. These upgrades are often dependent on community votes, and while they offer flexibility, they can also result in delays in making key changes.

Conclusion

While Tezos offers innovation through Liquid Proof of Stake and strong governance features, potential risks like the Tezos Foundation’s control over the token supply, influence of founder Arthur Breitman, lack of liquidity, and the slow pace of ecosystem development should be carefully considered before fully adopting the network. Transparency, decentralization, and governance will be key factors in determining the future success of Tezos in the competitive blockchain space.